39+ can i claim mortgage interest on taxes

Then yes you can enter the interest paid on the mortgage. Ad Over 90 million taxes filed with TaxAct.

Mortgage Interest Relief Restriction Mercer Hole

Web You can treat a home under construction as a qualified home for a period of up to 24 months but only if it becomes your qualified home at the time its ready for.

. Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Short videos for a long list of topics. Web 1 Best answer.

June 4 2019 557 PM. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000.

Filing your taxes just became easier. If you are on the deed with someone else you should divide the. So if each person paid 50 of the mortgage each person is only eligible to.

File your taxes stress-free online with TaxAct. For tax years before 2018 the interest paid on up to 1 million of acquisition. Web Basic income information including amounts of your income.

750000 if the loan was finalized after Dec. Web The answer is that you can only claim the deduction for the interest you actually paid. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web Based on first-year interest costs for a 30-year fixed-rate mortgage at the current national average rate of 365. If they are incurred for the purpose of earning income by renting property to tenants the.

Start basic federal filing for free. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web Watch videos to learn about everything TurboTax from tax forms and credits to installation and printing.

Web The IRS places several limits on the amount of interest that you can deduct each year. For married taxpayers filing a separate. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Web Mortgages can be considered money loans that are specific to property. You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your home. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. For taxpayers who use. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. E-File Your Tax Return Online. The table above shows that if youre single.

Homeowners who bought houses before.

Changes To Tax Relief For Residential Property Landlords Business Clan

Mortgage Interest Deduction Bankrate

Upad Mortgage Interest Relief Calculator How Much More Tax Will You Be Paying

![]()

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction Rules Limits For 2023

Bdcc Free Full Text Big Data And Its Applications In Smart Real Estate And The Disaster Management Life Cycle A Systematic Analysis

Can You Claim Mortgage Interest On Taxes Pocketsense

Is Mortgage Interest Tax Deductible The Basics 2022 2023

Section 24 Landlord Tax Expert Insights On Phase 2

Mortgage Interest Tax Relief Changes Explained Taxscouts

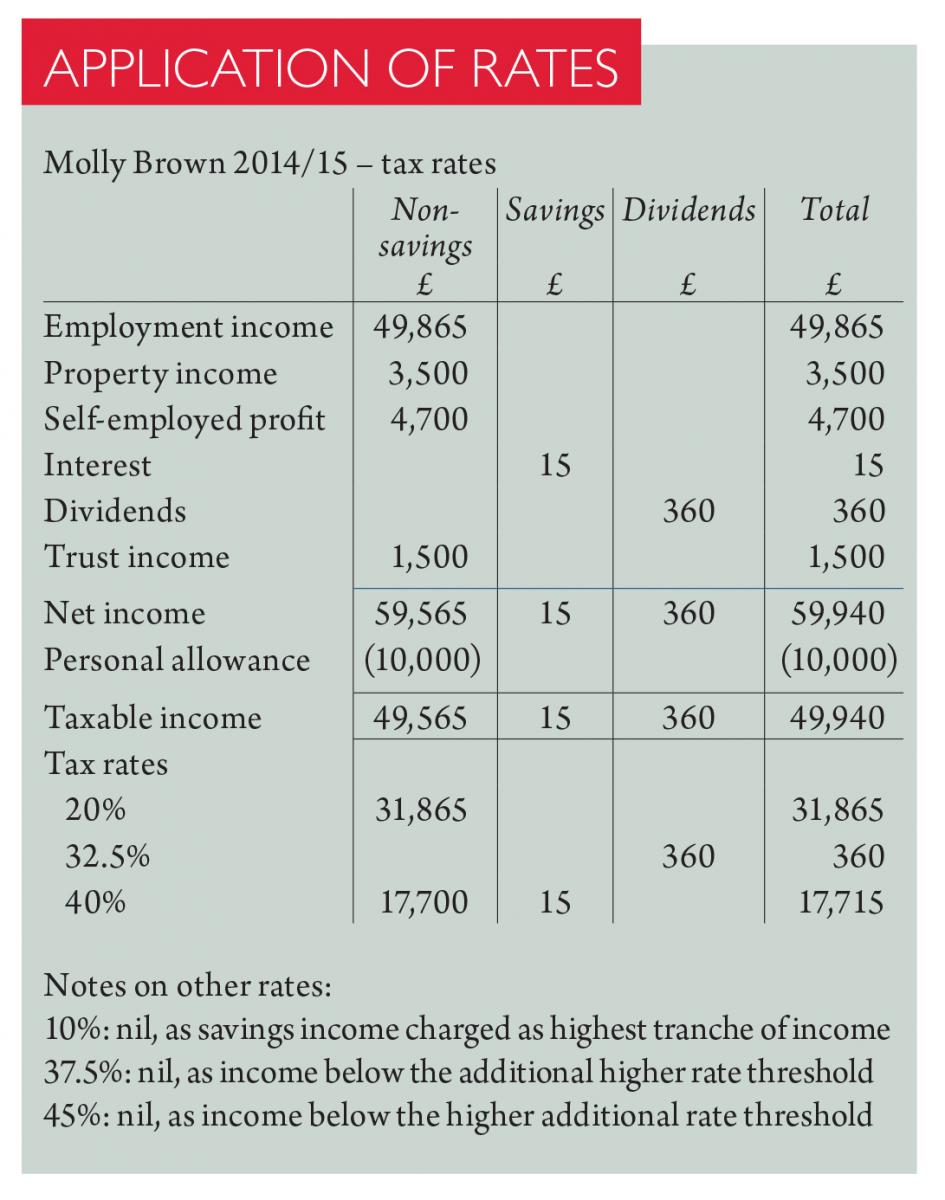

Seven Steps To Heaven Taxation

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

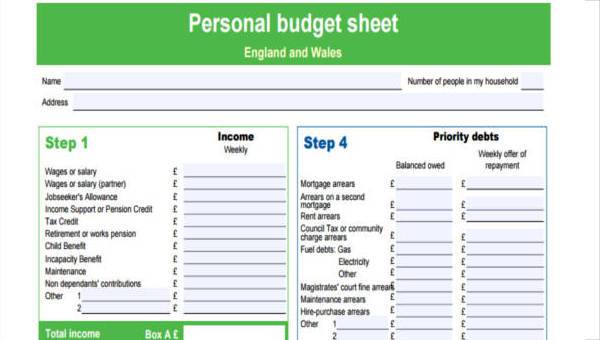

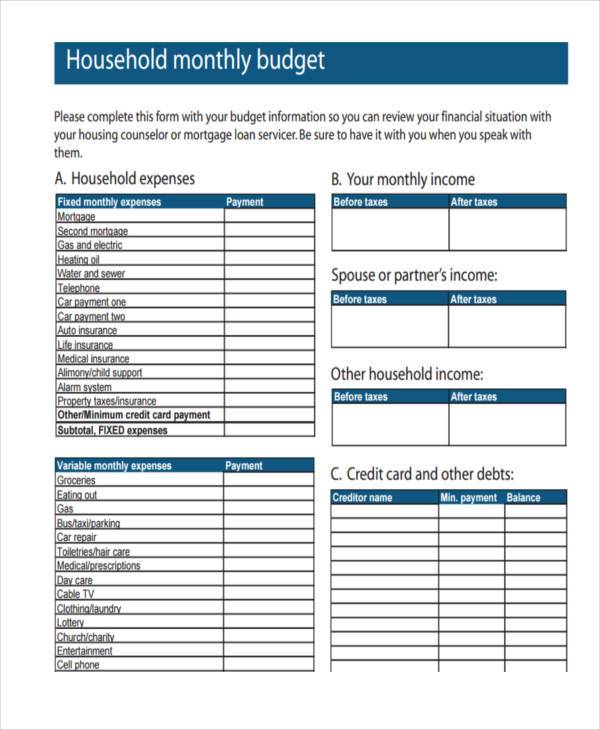

Free 39 Sample Budget Forms In Pdf Excel Ms Word

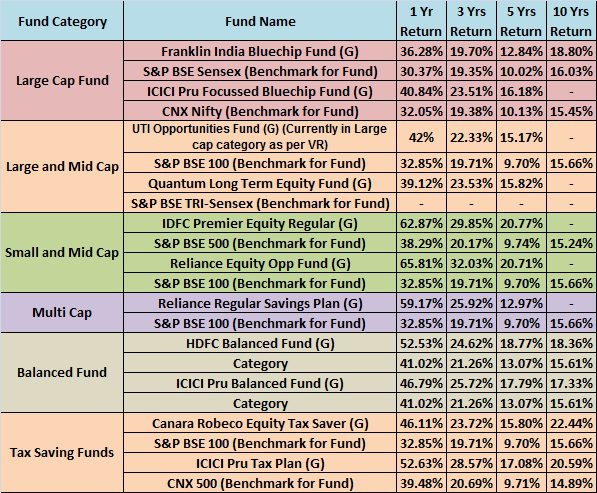

Top 10 Best Mutual Funds To Invest In India For 2015

Free 39 Sample Budget Forms In Pdf Excel Ms Word

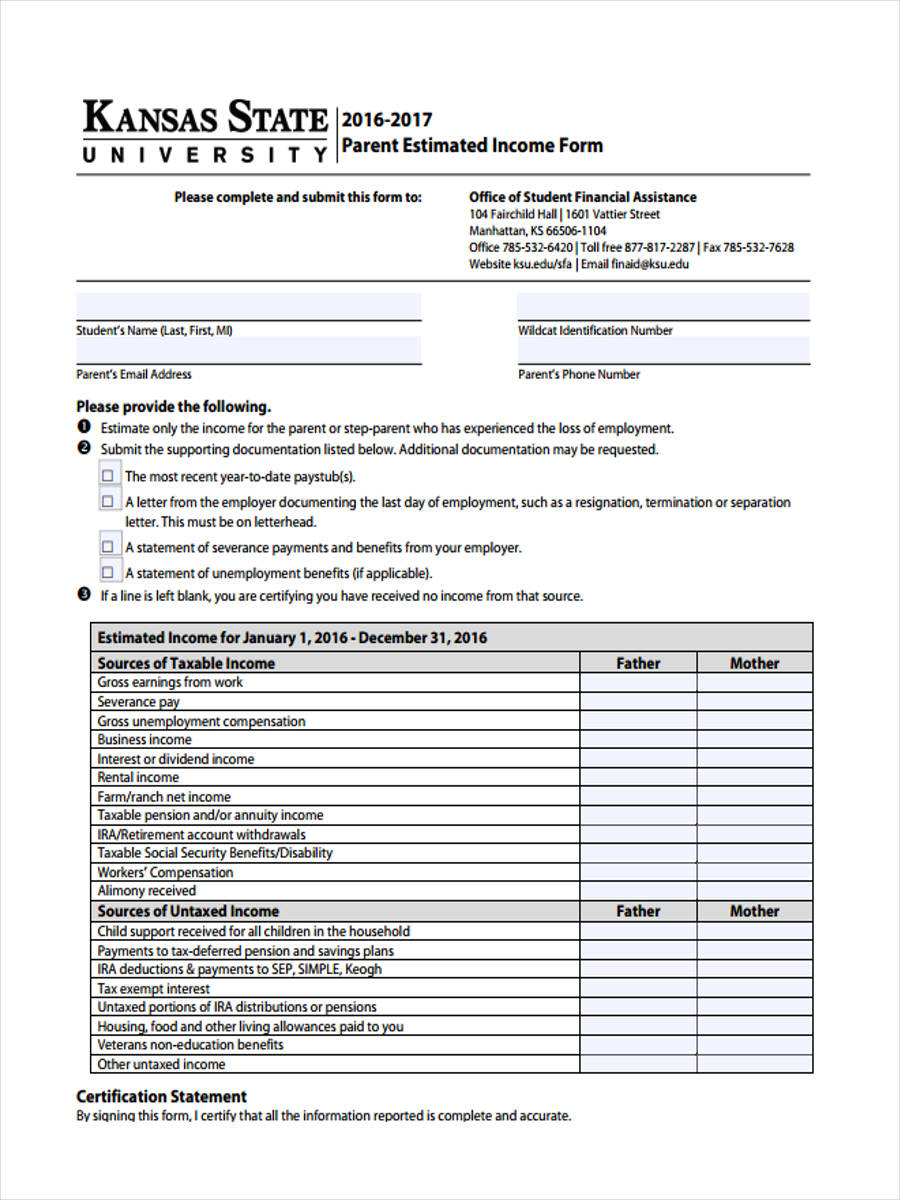

Free 39 Estimate Forms In Pdf Ms Word

186 County Farm Road Dover Nh